FAQs

Frequently asked questions. If you have a question you need a response to please submit this to us via the contact form here

For Art Market Professionals

-

AMPs have differing costs associated with resales. Is it fair that AMP’s costs aren’t factored into the calculation of the royalty

Art market professional’s concerned about whether the royalty accounts for differing AMP costs should note that the royalty is calculated exclusive of (i.e. disregards) any costs associated with the resale.

This leaves it up to the art market professional, the buyer, and the seller, to freely agree their costs, premiums, commissions etc and determine what is, in their particular circumstances, fair and lawful between them.

It is not the purpose or function of the legislation to presume, dictate, or discriminate those private commercial arrangements. Instead, the legislation creates a predictable royalty by using a fixed percentage of the resale value. This is the same for every qualifying resale, and every liable AMP.This creates benefits to art market professional and artists alike. Negotiation, custom, and freedom of contract, will determine fairness between parties to the resale contract as to their own costs, premiums etc. And whatever they freely decide about those (and however that varies case-by-case), won’t prejudice or affect the “resale value” or the royalty total, which also ensures transparency and fairness to the artist.

-

Can the Auction House put a fee on top of the sale to cover that 5%? Is it on the hammer price?

The resale royalty payable is calculated at 5% of the “resale value” of the qualifying resale (section 16).

Section 10 says that “resale value” means: “the value of the consideration given for the visual artwork under the contract for resale”.

This may include:

- the amount paid in New Zealand dollars;

- the value of goods and/or services paid in kind;

- (if paid in another currency), the amount converted to NZD at the date of payment.

It does not include:

- goods and services tax (GST); or

- duties, levies, or taxes (etc) under the Customs and Excise Act 2018; or

- “any costs associated with the resale, for example, a commission or a buyer’s premium”

For an explanation of how “resale value” is calculated, please see our FAQ entry here: How is the resale value calculated?

This FAQ explains the details of the resale royalty calculation and includes the legal wording, along with an explanation and example. It also clarifies that other costs like taxes, commissions, and premiums are separate from the “resale value.”

AMPS should also be aware of other rules in the Act that prohibit them from charging, repaying, or sharing the artist’s resale royalty:

- An artist cannot ‘alienate’ their royalty right during their lifetime (s 13). This means an artist cannot lose, sell, license, assign, charge, or waive their resale right during their lifetime, and any agreement to do so is void (s 13(2)).

- Any agreement to repay the resale royalty is void (s 17(5)), as is any agreement to share the royalty (except where the Act provides that a royalty can be held in shares e.g. where there are joint artists (s 12), or multiple successors (s 14(4)).

-

Do we report the resale if we don’t know the name of the artist or maker?

Yes, even if you do not know the artist or makers name(s) we kindly ask that you report all qualifying resales to us. Please provide any information you can about the works origins (if known). RRA’s role is then to determine if the resale is eligible for a royalty or not and will accept or decline the report and update you accordingly.

-

How does the scheme affect Art Market Professionals?

There are legal obligations for Art Market Professions which require them to:

- report qualifying resales of original visual artworks to RRA; and

- pay to RRA* the resale royalty payable in respect of each qualifying resale. The seller is also jointly & severally liable for payment.

These are explained in our Guide: Information for Art Market Professionals.

Please register to stay informed about your obligations under the scheme, and to receive administrative support with compliance.

(*This assumes the Art Market Professional is acting as agent for the seller on a resale. In cases where there is no agent for the seller, then instead the buyer’s agent or the buyer will be jointly liable with the seller to make paymen

-

I’m not sure the resale qualifies, do I still report it?

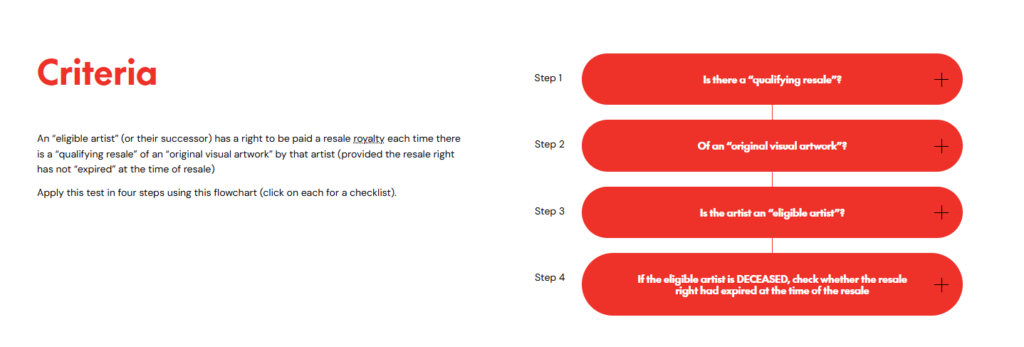

In the first instance, please see our step-by-step flowchart under the ‘Criteria’ section on our Homepage here. If you are still unsure, contact us.

-

Is there any process we should follow to determine whether a sufficiently “limited number of copies” of a item exist to determine whether the work is an original visual artwork or not?

If copies are not numbered as with a limited edition print, and there is no other information available to help ascertain how many copies have been made, then you can possibly assume it is not a sufficiently limited number and therefore not a qualifying resale. The Act does not define what a limited number of copies is, although there is provision in the Copyright Act that a 3 Dimensional artwork that has fewer than 50 copies produced is copyright protectable, so this might be a useful benchmark. We suggest using good faith best efforts to do your due diligence in researching, and keep a record of your research in case it is needed at a future date. If you have any concerns or want to discuss then please just get in touch with us.

-

Should a resale involving an artist from overseas be reported to Resale Royalties Aotearoa (RRA)?

Yes, any qualifying resale of an original artwork, regardless of the artist’s country of origin, must be reported to Resale Royalties Aotearoa (RRA).

Our role at RRA is to assess the eligibility of the artist and verify the validity of the resale right, ensuring it has not expired. As Aotearoa’s Artist Resale Royalty Scheme includes reciprocal arrangements with a continuously expanding list of international territories, including numerous EU countries and other parts of the world, it is important to report all such resales.

Please be advised that for any reported resale where the artist is deemed ineligible or the resale right has expired, no royalty will be applied (meaning RRA will not invoice for the reported resale).For a list of reciprocating countries, please refer to the list available on our website here: Sister societies. Please note however that RRA may update this list from time to time without notice.

-

What do I need to do as an Art Market Professional?

Art Market Professionals:

- Art Market professionals have certain obligations and liabilities under the Scheme. These are explained in our Guide: Information for Art Market Professionals.

- Please register to stay informed about your obligations under the scheme, and to receive administrative support with compliance.

-

Who is an Art Market Professional?

The Act defines “Art Market Professionals” in section 11 as:

(a) a person who carries on business as an auctioneer (within the meaning of section 5(3) of the Auctioneers Act 2013):

(b) an art dealer:

(c) an art consultant:

(d) the owner or operator of an art gallery that deals in visual artworks:

(e) any other person who is in the business of dealing in visual artworks.

For Artists

-

How do artists from countries other than NZ benefit from resale royalties?

Australia and the United Kingdom are reciprocating countries. RRA collects royalties for Australian and United Kingdom artists when they make a qualifying resale in New Zealand, and vice versa.

-

What can an artist do if they don’t want to accept a royalty?

How to decline payment (s 19 the Act, & clause 12 the Regulations)

A right holder may opt to decline to receive:

- payment of all or part of a resale royalty; and / or

- payment of a resale royalty on the future resale of any or all of their visual artworks.

They do this by giving written notice to RRA (the collection agency).

This doesn’t mean they lose their resale right. It simply means they are opting to decline to receive payment of all or part of a resale royalty/ies.

Opting back in for future resales (s 19(3) the Act, & clause 13 the Regulations)

If the right holder has declined payment of a resale royalty on future resales, they may nevertheless opt back in to receive payments on future resales of any or all artworks previously declined. They do this by giving written notice to the collection agency.

What happens to the declined royalty? (clause 14 the Regulations)

If a right holder declines to receive payment of any amount of a resale royalty, RRA must:

- transfer the amount to a cultural fund established under the Act;

- if there is no cultural fund established, return the amount to the person who paid the resale royalty under the Act;

- if there is no cultural fund, and the person who paid the royalty cannot be found, use the amount to fund the activities of the collection agency under the Act.

Can I get rid of, or repay, or sell, or share my resale right?

For artists: An artist cannot ‘alienate’ their royalty right during their lifetime (s 13). This means an artist cannot lose, sell, license, assign, charge, or waive their resale right during their lifetime, and any agreement to do so is void (s 13(2)).

For successors: A successor may transfer the resale rights they hold to another person, as personal property, by (a) assignment; or (b) testamentary disposition; or (c) operation of law (s 14(2)).

For both: Any agreement to repay the resale royalty is void (s 17), as is any agreement to share the royalty, except where the Act provides that a royalty can be held in shares e.g. where there are joint artists (s 12), or multiple successors (s 14(4)).

-

What do I need to do as a Visual Artist?

- Please register your interest with RRA to ensure timely payment to you.

- Registering your eligibility in advance greatly assists RRA to administer the scheme on your behalf. It assists RRA to identify, collect, & distribute your royalty payments to you in a timely fashion

-

What is IRD tax guidance for artists?

Artists are entitled to receive a payment each time their art is resold (a resale payment). These payments may be taxable.

If you are an artist who was in business when your artwork first sold, you need to pay income tax on resale payments for that art. This is because resale payments are not taxed before they are paid to artists.

RRA’s admin fee “is a deductible expense” for artists who are in business.

Read the full IRD ‘Resale payments for artists’ here.

-

What is the process for claiming an unpaid resale royalty?

RRA will periodically inspect and audit published auction sale results to monitor compliance with the Act and Regulations. However, because we rely on art market professionals and other stakeholders in the Scheme to notify us of resale payments that are due on qualifying resales, we may occasionally not be aware of a qualifying resale.

A Right Holder who believes that a qualifying resale has taken place is encouraged to notify us through the “Contact Us” form available on our website.

Right Holders have 6 years from the date of the qualifying resale to notify us of any claim from the date of the resale. After that period expires, we will have no liability to the Right Holder to collect or pay the resale royalty.

If a Right Holder wishes to notify us of a resale royalty they think they are owed, they must provide us with:

- Evidence that the person is the Right Holder

- Evidence that the relevant resale is a qualifying resale

- The names of the persons liable under section 17 of the Act to pay the resale royalty, if known.

On receipt of such a notice from a Right Holder, we will use reasonable efforts to verify the claim. If the claim is verified and we have not already processed the relevant resale royalty payment, we will notify the persons who are liable to pay the resale royalty of their obligations under the Scheme and follow our process set out above for collecting and distributing the resale royalty payment. We will then have no further obligation to the Right Holder until we receive the resale royalty payment. While we will use reasonable efforts to resolve claims, we cannot guarantee any particular outcome.

-

Who is an “eligible artist”?

Checklist 3.1 IF the artist is alive at the time the contract for resale is entered into: is the artist:

- a New Zealand Citizen, or a person domiciled or resident in New Zealand; or

- a citizen or subject of, or a person domiciled or resident in, a “reciprocating country”

If you ticked either of these boxes, then the artist is an eligible artist.

Checklist 3.2 IF the artist is deceased at the time the contract for resale is entered into: at the time of their death was the artist:

- a New Zealand Citizen, or a person domiciled or resident in New Zealand; or

- a citizen or subject of, or a person domiciled or resident in, a reciprocating country

If you ticked either of the above, then the deceased artist is an eligible artist. Although the eligible artist is deceased, the resale right is held by their successor(s) (meaning the successor(s) are entitled to payment of the royalty, provided they meet the same criteria for eligibilit

-

Why didn’t I get a royalty when my work was sold at auction?

There are several steps to process a royalty payment once an artwork as been resold.

- The Art Market Professional reporting the resale has 60 business days to do so.

- Once the report has been reviewed by our research team, the royalty will be either approved or declined.

- Any approved resales will then be invoiced for the royalty amount.

- Artists or the successors are then notified quarterly.

We encourage all eligible artists and successors to register with us. Even if you haven’t been notified of a royalty payment yet, registering ensures we can contact you quickly when one becomes available.

Why you might not have received a royalty:

- Given the royalty scheme only commenced on December 1, 2024, if your work sold prior to this, a royalty would not apply to that resale. The Act is not retrospective.

- Art Market Professionals have 60 business days to report resales, so it’s possible we haven’t received a report for your works resale yet.

What to do now:

- Check the sale date: Confirm the exact date the resale happened. If it was before December 1, 2024, the royalty doesn’t apply.

- Check your work meets the criteria under the scheme: Please see our step-by-step flowchart under the ‘Criteria’ section on our Homepage here

- Register with RRA: We may already have a royalty payment for you but have been unable to find your contact details, or we may have a royalty in our next quarterly distribution. You can register at any time by completing our online form here: Resale Royalties Aotearoa – Registration Form

- Contact RRA: Should you believe your work has been resold and meets the specified criteria, and you have not received notification of a royalty payment, kindly provide us with the relevant details via our contact form here: Resale Royalties Aotearoa – Contact Us. We will then conduct a further review.

For Successors

-

What do I need to do as a Successor?

- Please register your interest with RRA to ensure timely payment to you.

- Registering your eligibility in advance greatly assists RRA to administer the scheme on your behalf. It assists RRA to identify, collect, & distribute your royalty payments to you in a timely fashion

- Please note that each Successor must register with us individually, if the rights are held by a Trust, then the Trust can register. For any queries on this process please contact us.

-

What happens if the artist has died?

After an artist’s death, the right to receive the resale royalty payment passes to their successor. However, the successor must meet the same eligibility requirement to receive payment (meaning they are a citizen or domiciled or resident in New Zealand or a reciprocating country or in the case of a body corporate, they are incorporated, registered, or carrying on business in New Zealand or a reciprocating country).

Multiple Successors: If there are 2 or more successors that hold a resale right after the artists death, each successor holds the share of the right that they inherit or that is transferred to them. All successors must register with RRA prior to payment of a royalty.

Can a Trust receive a royalty? Yes, if the trust holds the resale right then the Trust can register as the successor with RRA. Please contact us for more information.

-

What happens when the artist died before 1st of December 2024?

When the artist has died before the commencement of the Act, it is not their will that determines who succeeds the resale right – but rather NZ intestacy legislation. This is required by Section 2 of Schedule 1 of the Act (transitional provisions).

In other words, the artists resale right will be passed to one or more successors “as if” they died intestate (i.e. left no will).How to Apply Intestacy Rules

The relevant intestacy rules to be applied are set out in the Administration Act 1969, in particular Part 3 (sections 75-80).

Specifically – answers can be found by applying the table at section 77, in two steps:

- First, look at the left-hand column, and select the most accurate description of who were actually left behind by the deceased (e.g. spouse, children, parents etc).

- Second, based on the correct selection, the second column tells us how the estate (and Resale Right) is to be distributed between that person or people.

Example

- First, looking at the left-hand column of section 77, identify the correct class of people. Choose the one which most accurately describes who actually survived the deceased (e.g. spouse, children, parents etc). This could be one of 8 different combinations, for example: did the deceased leave behind:

- a surviving partner (husband, wife, de facto) but no children (example numbered “1”); versus

- a surviving partner, and children (example numbered “2”); versus

- a surviving partner, no children, but one or both parents (exampled numbered “3”); versus

- no surviving partner, but children and parents (example numbered “4”);

- etc.

- Once we’ve identified which of the 8 combinations applies, see the second column for how the estate is divided.

Let’s assume that the artist was survived by: 1 spouse, and 2 children. Looking at the left-hand column of section 77, this matches the example numbered “2”. Based on this selection, the right-hand column states that the beneficiaries to the estate residue are 1/3 to the spouse, and 2/3 to the two children (in equal shares).

Note: if one of the successors subsequently dies, then their share will pass to their own successors (either under their will, or if they died before the Act then applying the same rules above.

Distributing the Resale Royalty

To claim your share of a resale royalty each successor will need to register with RRA here

When registering, you will need to confirm your identity and your share of the resale royalty as per the intestacy law.

When more than one successor claims a share in the resale royalty, we may need to verify each person’s respective share before making a distribution. This is explained further in paragraph 11 of RRA’s Distribution Policy.

In plain English terms:

Who inherits the artist’s resale right?

- The artist died before the 1stDecember 2024, it is determined by the New Zealand intestacy law.

- The artist died after the 1st December 2024, it can be determined by the artist’s will.

Why is the will not recognised when they died before the 1st of December 2024? Resale Right for Visual Artists Act states that when the artist died before the Act started then the intestacy law applies because the resale right did not exist before then.

How do I work out my share of the resale right?

1. Identify your situation: Look at the descriptions on the left-hand column to match your situation. Refer to section 77,

2. Determine the distribution: The right-hand column for that selection then tells you how the resale right is to be shared.

Here is an example:

If you are the child of an artist who was survived by a partner and two children, Section 77 would indicate the partner gets 1/3 and the children get 2/3 (split equally between them). You would then get 1/3 of the resale right royalties.

Note: In the Administration Act 1969, “issue” refers to a person’s direct decedents including children, grandchildren etc.

What happens to my share of the resale right if I die? Your inherited share of the resale right will pass on to your own successors as per your will, or if there is no will then the intestacy law is applied.

Questions? Please contact us at kiaora@resaleroyalties.co.nz

-

What happens when the sale is from an Artist’s Estate: Is it a Resale?

The resale royalty scheme applies to all sales after the first transfer of ownership (whether that first transfer was for money or not).

This means it’s important that the parties consider whether the estate sale in question is (or is not) the first ever transfer of ownership of the artwork, or rather whether there has been a previous transfer of ownership.

For example:

- If the executor/administrator of an artist’s estate sells an artwork created by the artist, then assuming this is the very first time ownership that specific artwork is being transferred, then it is not considered a “resale” under the Artist Resale Royalty Scheme. In this scenario, the sale by the estate is effectively that “first transfer” out of the artist’s original ownership – regarded as if it were a sale by the deceased artist themself (with the executor acting as their representative).

By contrast, the royalty only applies to second (or subsequent) sales after the artwork’s first transfer from the original artist. For instance:

- If the deceased artist was not the first owner of the artwork. Say the estate includes an artwork that was acquired by the deceased artist (including by gift or inheritance). In this scenario, the estate’s sale of the artwork would be a second or subsequent transfer of the artwork, and subject to the scheme.

- If the sale is by a successor – they are not the first owner of the artwork. They have inherited the artwork from the deceased artist, meaning there has already been a first transfer of ownership from the artist (via the estate) to the successor. That first transfer is not a resale, however, if the successor chooses to sell the artwork, it will be subject to the scheme.

- Similarly, if the estate gifts the artwork (say to a museum or gallery), the giftee is not the first owner. If the giftee subsequently sells the artwork this is a resale for the purposes of the scheme.

- If a purchaser buys the artwork directly from the estate, and that purchaser chooses to subsequently auction the artwork, this would be the second or subsequent transfer of ownership and subject to the scheme.

-

When does the resale right expire?

In the case of deceased eligible artists, their resale right may or may not have expired. A resale royalty will only be payable if the contract for the resale was entered into on or before the following expiry dates (as applicable):

- (where the artwork is by a single artist) – the expiry date is 50 years from the end of the calendar year in which the artist died

- (where the artwork was created jointly by 2 or more artists) – the expiry date is 50 years passed from the end of the calendar year in which the last of those artists died.

If the resale contract was entered on or before the expiry date, a resale royalty is payable.

If the resale contract was entered into after the expiry date, no resale royalty is payable.

For GLAM

-

Are GLAM gift shops acting as AMPs when selling original visual artworks to their customers when the first sale is between the artist and the GLAM gift shop?

In this case yes, as the GLAM gift shop can be regarded as “any other person who is in the business of dealing in visual artworks”, they will fit the definition of an AMP under the act. In any event, the obligations will be the same whether they are regarded as a GLAM member or an AMP, as the responsibility will be on them to report and pay the relevant royalty if required.

-

How does the scheme apply to GLAM organisations?

The scheme applies to:

- publicly funded art galleries; and

- publicly funded museums, libraries, and archives that collect and display artworks (“GLAM”).

Three ways the Scheme affects GLAM:

- GLAM are not Art Market Professionals (AMPs).

- However, resales involving GLAM do fall within the Scheme. If any GLAM is involved in a resale of original visual artwork it may still count as a “professional resale” and therefore a “qualifying resale”. Forr assistance with what is a “qualifying resale” see our step-by-step Flowchart under the ‘Criteria’ section on our Homepage here.

- GLAM don’t have liability for paying the royalty. Generally, GLAM aren’t required to report to RRA on qualifying resales either, UNLESS there are no Art Market Professionals involved in the resale. In that event, then each GLAM will be responsible for reporting information about the resale to RRA.

-

In the example where a GLAM gift shop is acting as an AMP – are they required to report buyer information for qualifying resales in a retail context (e.g. an American Tourist purchases art)? What if the GLAM gift shop is prepared to assume full liability for the resale?

Section 21 of the Act details the reporting requirements which includes as follows:

(a) the name of the artwork, if known:

(b) a brief description of the artwork:

(c) the resale value:

(d) the name of the artist, if known:

(e)the name and contact details of the persons liable under section 17 to pay the resale royalty, if known:

(f) any other information specified by the regulations.

If the GLAM gift shop assumes full liability for payment of the royalty, then RRA would not require the shop to report the name of the buyer, because liability will be discharged as soon as full payment is received by RRA.

-

In the RRA guidelines, it states RRA will ‘verify’ GLAM’s reports. What does this involve?

RRA will review resales reports for detail and completeness, as defined by the Act and Regulations. The objective of verifying reports is to have complete and accurate information to support rights holder identification and distribution processes, ensuring timely payment to the artist(s) or successors(s).

-

Is protest art an original visual artwork (e.g. a protest placard)?

We consider that each respective GLAM is best qualified to determine whether an item meets the definition of “original visual artwork”. Section 8(2) defines visual artworks as:

In this Act, visual artwork—

(a)includes a visual work of any 1 or more of the following types:

(i)a cultural expression of Māori:

(ii)a cultural expression of Pacific peoples:

(iii)ethnic or cultural art that is a variation of a type of work described in any of subparagraphs (iv) to (ix):

(iv)painting, drawing, carving, engraving, etching, lithography, woodcutting, or printing (including a book of prints):

(v)sculpture, collage, or modelling:

(vi)craftwork, ceramics, glassware, jewellery, textiles, weaving, metalware, or furniture:

(vii)photography or video art:

(viii)multimedia art:

(ix)art that is created using computers or other electronic devices

(b) does not include—

(i) a building, as defined in section 2(1) of the Copyright Act 1994:

(ii) a dramatic work or musical work, as those terms are defined in section 2(1) of the Copyright Act 1994:

(iii) a literary work, as defined in section 2(1) of the Copyright Act 1994, unless it is a compilation that includes a visual work of a type specified in paragraph (a)(i) to (ix):

(iv) a work of a type specified in the regulations.

-

Is the GLAM required to report a qualifying resale in instances where they have not identified the artist? e.g. Maori artifact

Yes. A GLAM must report all “qualifying resales” (even if the identity of the artist is unknown – see section 21(2)(d)).

Please note, however, that not every qualifying resale the GLAM reports will necessarily attract a royalty. If the artist is unknown to the GLAM, RRA will nevertheless attempt to identity the artist in order to confirm whether or not they are eligible for a royalty. RRA will receive and review the full report, then confirm to the GLAM which resales are (or are not) liable for a royalty in accordance with the Act, and then invoice accordingly.

For assistance with what is a “qualifying resale” see our step-by-step flowchart under the ‘Criteria’ section here Resale Royalties Aotearoa | Toi Huarau

-

Should a GLAM purchase an item of jewellery in 2023 attributed to an artist from Palmerston North who died in 1959. Is it correct that this doesn’t qualify for the royalty as the known maker died more than 50 years ago?

Correct this is no longer a qualifying resale (assuming it would otherwise have been), as the right to a resale royalty for this Artist expired fifty years from the end of the year that they died, ie at the end of 2009.

-

We often buy acquisitions as lots and within those lots there might be qualifying items, for example, a sketch valued over $2000. How should we declare a select item?

We suggest using good faith best efforts to do your due diligence, which is probably exactly what you will have done anyway as part of your research into identifying each item you purchase. We recommend you keep written records of your due diligence in case it is needed in the future, but we will not be auditing your decisions unless independently requested to do so.

Report the individual item not the lot and include the details as you can – i.e. the artist’s name and details of the sketch, the seller of the lot, and the date of the acquisition. And again, if in doubt please contact us.

-

What are the GLAMs reporting obligations when reporting a qualifying resale when the purchase is made from a collective? (e.g A group of artists who work collectively or under an umbrella ‘collective’ organisation).

The same reporting rules apply. Assuming it is a qualifying resale (i.e. not a first sale), the responsible party must report the sale under section 21. That must include information about the name of the artist (or artists) if known.

-

What doesn’t count as visual art? Clothing? Or does haute couture count as visual art?

Section 8 of the Act defines what is a visual artwork, and does not refer to clothing – although it does refer to drawings and textiles, so while the clothing items themselves may not be regarded as an original visual artwork, the underlying drawings that they are based may be regarded as an original visual artwork, and the same with the textile designs. Arguably if the clothing item is at the level of a WOW entry, it might be regarded as sculpture and therefore would be included in the definition of an original visual artwork.

-

What if the seller or donor to a GLAM wishes to remain anonymous?

If the GLAM assumes full liability for payment of the royalty, and pays the royalty to RRA, then RRA would not require the GLAM to provide the name and contact details of the seller. The GLAM (and the seller’s) liability becomes fully discharged as soon as full payment is received by RRA.

Regarding any anonymity concerns, please be assured that personal information provided to RRA is not shared publicly. In particular, seller information received by RRA is not shared with the Government nor any other third party – rather it is used only for the purposes of ensuring payment of the royalty to RRA. Please refer to our Privacy policy for more information.

-

What is the time limit for retrospectively reporting a resale when additional information to support a qualifying resale becomes available?

Section 17 (2) of the Act states that the liablity for payment of a resale royalty arises on completion of the qualifying resale, and Section 17 (3) of the Act states that liability is discharged when the total amount of the resale royalty is paid to the Collection Agency. This means that there is no time limit for retrospectively reporting a resale, and so in the event you discover a liability you must report and make payment to RRA within the timeframe (Section 17 (4). Section 8 of the Regulations states the applicable time frame is as follows:

Payment of the resale royalty must be made to the collection agency within 60 working days after the later of the following:

(a) the date on which the qualifying resale is completed:

(b) the earliest date on which a person liable under section 17 of the Act to pay the resale royalty becomes aware that they are liable to pay the resale royalty.

-

When a GLAM that operates a gift shop makes a sale of an original visual artworks that has been purchased directly from the artist, is this regarded as qualifying resale?

If the GLAM gift shop has actually purchased the original visual artworks from the artist, this is the initial sale, and when the GLAM gift shop sells the item to their customer this is a resale which will be regarded as a qualifying resale, assuming the other criteria are met.

If however, the artist has instead consigned the original visual artworks to the GLAM gift shop to sell on their behalf, then there has not yet been any sale or transfer of ownership as ownership remains with the artist, in which case when the GLAM gift shop sells the original visual artwork to their customer it will be the first sale rather than a qualifying resale and no reporting or royalty will be required.

For Buyers and Sellers

-

How are voluntary qualifying resales enforced?

A “Voluntary Qualifying Resale” means that all parties to the resale agree in writing that the resale is a qualifying resale for purposes of the Act; and what % of the resale value they agree will be payable to the artist as a resale royalty; and who will provide the relevant information to the Collection Agency.

If these conditions are met, and reported to RRA, then RRA will treat the voluntary qualifying resale like any other for the purposes of the Act, including in regard to enforcement. To report a voluntary qualifying resale use this form.

-

If I’ve been gifted or inherited an artwork; do I need to pay a resale royalty?

No, the first transfer of ownership of an artwork, whether acquired through gift or inheritance, does not trigger a resale royalty obligation. The Artist Resale Royalty Scheme specifically applies to “resales,” which are any subsequent transfers of ownership following the artwork’s first transfer.

As a “Resale” does not include the first transfer of ownership of the artwork (irrespective of whether the first transfer of ownership was made for money or other consideration) you would not need to pay a resale royalty.

However, if you decide to then sell an artwork that was gifted to you or inherited by you, and the criteria for a qualifying resale is met, then a royalty will be due.

You can check if there has been a qualifying resale on our flowchart here: Is there a “qualifying resale”?:

-

Who calculates resale value in a “voluntary qualifying resale”?

Section 9(3) of the Act states that any resale other than a professional resale may be a “voluntary qualifying resale” all the parties to the resale agree in writing that the resale is a voluntary qualifying resale, and what percentage of the resale value will be payable as the ARR, which in effect means both the buyer and the seller. (In addition to agreeing on the value of the resale royalty both the buyer and the seller will also need to determine who is responsible for notifying and paying RRA the royalty amount.) See Checklist 1 of the Criteria Flowchart on our Homepage for more details.

For Education Institutions and other organisations

-

Does the Resale Royalty apply to Universities that are publicly funded?

Just because a University receives some public funding for its operations, does not make it a “publicly funded art gallery” or “a publicly funded archive that collects and displays artworks”. Universities receive funds and revenue from many sources. Any artworks the University has collected and displayed may have been purchased other than with public funds (e.g. through University operating revenue, sales of assets, or private bequeaths or foundations). The proportion of public funding it does receive is likely to be ear-marked and attached to tuition, rather than for the purpose of operating an art gallery or archive to collect and display artworks.

Universities may establish special bodies to collect and display artwork. But unless that special body is in effect operating as an art gallery or archive (etc) that collects and displays artworks, and its operation is publicly funded (e.g. it applies for and receives public funding for that purpose) then resales involving that body are unlikely to automatically qualify as a professional resale (unless an AMP or GLAM is involved in the resale).

-

How does an educational institution sit with respect to the Scheme? Are their resales “professional resales”?

Section 9(2)) mentions publicly funded libraries, museums, and archives that collect and display artworks (GLAM), but not universities, who have extensive collections.

To be a “professional resale”, at least one person involved in the resale must be:

- an Art Market Professional or

- a publicly funded art gallery; or

- a public funded museum, library, or archive that collects and displays artwork.

(from section 9(2)(a)(i) to (iii)).

Universities and other educational institutions are clearly not listed in this definition, which means their sales and purchases of artwork won’t automatically be classified as a “professional resale”.

However, their sales and purchases will still qualify as a professional resale if at least“1 person involved in the resale” satisfies (a), (b), or (c) above. Examples include (but aren’t limited to):

- the University is buying from an Art Market Professional;

- the University is buying from a publicly funded archive that collects and displays artworks (or other GLAM);

- the University is selling and using an auctioneer to assist with the resale;

- the University is selling, and has engaged an art consultant to assist with a private resale;

- the University is selling to a private buyer, who is using an Art Market Professional or an art consultant to assist them with the resale;

General

-

Has there been any consideration regarding the extension of copyright duration that will be enacted sometime in the next four years?

Currently the artist resale royalty will apply for 50 years after the death of the artist which aligns with New Zealand’s current Copyright Act. However our understanding is that the Copyright term will be extended prior 1 May 2028, and we would expect that the ARR term will then also be extended to align with the Copyright Act.

-

How do I update my details?

To update personal information and contact details, you can log into the RRA portal and make changes. To update declarations or any other information, please email us at kiaora@resaleroyalties.co.nz

-

How do you define ‘limited number of copies’?

The Act does not define what a limited number of copies is, although there is provision in the Copyright Act that a 3 Dimensional artwork that has fewer than 50 copies produced is copyright protectable, so this might be a useful benchmark. We suggest using good faith best efforts to do your due diligence in researching, and keep a record of your research in case it is needed at a future date. If you have any concerns or want to discuss then please just get in touch with us.

-

How does it work when an art consultant facilitates a resale between two private parties?

The resale is considered a professional resale because an art market professional is involved. That means, provided it meets the standard criteria, it will be a qualifying resale.

-

How does Section 7(3) of the Act relate to “commissioned” artwork?

Section 7(3) of the Act states “An artist has a right under this section irrespective of whether they are or were the first owner of copyright in the artwork.”

This means that if the artwork was “commissioned” (as per Section 21(3) of the Copyright Act), then the artist who created the artwork is not the first owner of the copyright, and is still therefore potentially eligible for the artist resale royalty, as long as they are an “Eligible Artist”, the artwork is an “original visual artwork” by the artist, and the resale occurs before the right to receive the ARR has expired (see checklist 4 for more detailed information on when the ARR right expires).

-

How is the resale value calculated?

The resale royalty payable is calculated at 5% of the “resale value” of the qualifying resale (section 16).

Section 10 says that “resale value” means: “the value of the consideration given for the visual artwork under the contract for resale” which may include:

- the amount paid in New Zealand dollars;

- the value of goods and/or services paid in kind;

- (if paid in another currency), the amount converted to NZD at the date of payment.

‘Resale value’ does not include:

- goods and services tax (GST; or

- duties, levies, or taxes (etc) under the Customs and Excise Act 2018; or

- “any costs associated with the resale, for example, a commission or a buyer’s premium”

Plain English Guidelines

In plain English, this means that the “Resale Value” is the amount the buyer has agreed to pay the seller for the artwork itself. All external and other associated costs (taxes, fees, or levies, etc) are separate to (not part of) the scheme or the Resale Value calculation. This ensures the value of the royalty relates directly to the value of the artwork itself, and is not subject to other external or variable factors.

For example:

An original visual artwork sells at auction. The sale and purchase agreement records that the buyer will pay $2,000 to the seller as consideration for the artwork (plus any applicable fees and taxes).

Under the AMP’s terms of service, the parties agree that the seller will pay the AMP a 20% commission ($400) for acting as its agent, and the buyer will pay the AMP a 15% premium (additional amount) ($300) for facilitating the resale.

Resale Value

Assuming the Act applies, in the example given above:

- The “Resale Value” is $2,000 because, in terms of s 10(1) of the Act, that figure represents the value “given for the visual artwork under the contract for resale”.

- In plain English, this is the amount the buyer has agreed to pay the seller “for the artwork”.

- The artist is entitled to a 5% share in that Resale Value = $100 in this example. (The AMP and the seller are jointly and severally liable to pay the $100 royalty to RRA).

Other Associated Costs:

Other fees, costs, taxes etc may or may not apply to the sale. These are, however, separate matters to the value given for the artwork.

It is important to distinguish these other transactions from the “Resale Value”. Note that commissions, premiums, taxes, and other costs are usually separately stated in your legal documents and invoices. For example, they may appear as separate & distinct line items to the hammer price, within the same invoice (or in separate invoices). They may appear in the AMP’s terms of service rather than in the contract for resale.

A helpful way to distinguish “Resale Value” from “costs associated” is first to ask (1) who is paying whom, and second to ask (2) in respect of what? For example, “Resale value” is (in plain English) the amount the buyer has agreed to pay the seller, for the artwork. By contrast:

- a “buyer’s premium” is, first, an amount the buyer has agreed to pay to the AMP (i.e. not buyer to seller). It is, second, not given “for the artwork”, but rather for the AMP successfully facilitating the resale.

- “commission” is, first, an amount the seller has agreed to pay the AMP (i.e. not buyer to seller). It is, second, not given as consideration “for the artwork”. Rather it is given for professional services related to the resale (e.g. marketing, valuation, handling & housing of goods, administration, auctioneering, and other professional services etc).

-

How much is the resale royalty payment?

The amount is the same for both eligible artists and successors, a 5% royalty will be collected for eligible artists each time there is a qualifying resale of their original visual artwork.

The collection and distribution of the payment is managed by RRA, a not-for-profit. RRA will retain 20% for the purpose of funding RRA operations and distribute the remainder of the royalty to the visual artist or successor.

-

How will the scheme work for galleries who often buy at auction to re-sell? Will the royalty be payable twice?

A royalty is payable on each resale.

Who is liable in each instance is answered by section 17 of the Act. The seller is always liable, and generally their agent will be jointly and severally liable. Generally a buyer won’t be liable unless no agent is involved.

To give two contrasting examples:

Where a gallery buys from an auction house or art consultant (who is acting behalf of a seller), the liable parties will be the seller and the seller’s agent (i.e. auction house or art consultant). It’s unlikely the purchasing gallery would be liable in this scenario (unless the seller actually has no agent, and the buyer has no agent).

Where a gallery buys directly from another gallery (without using any agents), then the buying gallery will indeed be jointly liable with the selling gallery to pay the royalty on the purchase. (How the two galleries share this liability will be a private matter). The buying gallery will then be liable as a seller if/when they come to resell.

-

Is a Resale Royalty applicable to artworks sold at a charity auction?

Yes, a qualifying resale of an original artwork sold as part of a charity auction is still subject to the artist’s resale royalty right. While the auction house or vendor may choose to waive their own fees or commission as a business decision, this does not exempt the resale from the artist’s entitlement under the Resale Royalty Scheme.

However, an artist may choose to decline to receive payment of all or part of a resale royalty, in which cases RRA will collect and manage the royalty in accordance with the statutory Regulations. These anticipate that the amount will be transferred to a Cultural Fund for the purposes of supporting the career sustainability of visual artists. Updates about the Cultural Fund can be found here later in 2025.

For any feedback or policy inquiries regarding this matter, please direct your correspondence to the Ministry for Culture and Heritage (MCH). Their contact details can be found within our complaints policy document, accessible here: Complaints Policy -

RRA policy on non-compliance

If a liable person fails to pay a resale royalty, or fails to provide the required reporting information, or if any other requirement of the Act is not complied with, then the Act provides that the Collection Agency may apply to a court for orders enforcing these obligations, and for any other order that is appropriate for an infringement of a property right. The Act provides that this does not limit any other proceeding that may otherwise be taken by the Collection Agency, a right holder, or any other person affected. Nor does it limit any other power of the court.

-

What are the requirements to report all secondary purchases to RRA, or only those that are a Qualifying Resale under the Act?

You are only required to report a Qualifying resale as defined in the Act. The scheme will operate on good faith and the belief that you are better qualified to determine whether a purchased item is a qualifying resale or not, and we will not be investigating your decisions unless independently alerted

-

What happens when the artist died before 1st of December 2024?

When the artist has died before the commencement of the Act, it is not their will that determines who succeeds the resale right – but rather NZ intestacy legislation. This is required by Section 2 of Schedule 1 of the Act (transitional provisions).

In other words, the artists resale right will be passed to one or more successors “as if” they died intestate (i.e. left no will).How to Apply Intestacy Rules

The relevant intestacy rules to be applied are set out in the Administration Act 1969, in particular Part 3 (sections 75-80).

Specifically – answers can be found by applying the table at section 77, in two steps:

- First, look at the left-hand column, and select the most accurate description of who were actually left behind by the deceased (e.g. spouse, children, parents etc).

- Second, based on the correct selection, the second column tells us how the estate (and Resale Right) is to be distributed between that person or people.

Example

- First, looking at the left-hand column of section 77, identify the correct class of people. Choose the one which most accurately describes who actually survived the deceased (e.g. spouse, children, parents etc). This could be one of 8 different combinations, for example: did the deceased leave behind:

- a surviving partner (husband, wife, de facto) but no children (example numbered “1”); versus

- a surviving partner, and children (example numbered “2”); versus

- a surviving partner, no children, but one or both parents (exampled numbered “3”); versus

- no surviving partner, but children and parents (example numbered “4”);

- etc.

- Once we’ve identified which of the 8 combinations applies, see the second column for how the estate is divided.

Let’s assume that the artist was survived by: 1 spouse, and 2 children. Looking at the left-hand column of section 77, this matches the example numbered “2”. Based on this selection, the right-hand column states that the beneficiaries to the estate residue are 1/3 to the spouse, and 2/3 to the two children (in equal shares).

Note: if one of the successors subsequently dies, then their share will pass to their own successors (either under their will, or if they died before the Act then applying the same rules above.

Distributing the Resale Royalty

To claim your share of a resale royalty each successor will need to register with RRA here

When registering, you will need to confirm your identity and your share of the resale royalty as per the intestacy law.

When more than one successor claims a share in the resale royalty, we may need to verify each person’s respective share before making a distribution. This is explained further in paragraph 11 of RRA’s Distribution Policy.

In plain English terms:

Who inherits the artist’s resale right?

- The artist died before the 1stDecember 2024, it is determined by the New Zealand intestacy law.

- The artist died after the 1st December 2024, it can be determined by the artist’s will.

Why is the will not recognised when they died before the 1st of December 2024? Resale Right for Visual Artists Act states that when the artist died before the Act started then the intestacy law applies because the resale right did not exist before then.

How do I work out my share of the resale right?

1. Identify your situation: Look at the descriptions on the left-hand column to match your situation. Refer to section 77,

2. Determine the distribution: The right-hand column for that selection then tells you how the resale right is to be shared.

Here is an example:

If you are the child of an artist who was survived by a partner and two children, Section 77 would indicate the partner gets 1/3 and the children get 2/3 (split equally between them). You would then get 1/3 of the resale right royalties.

Note: In the Administration Act 1969, “issue” refers to a person’s direct decedents including children, grandchildren etc.

What happens to my share of the resale right if I die? Your inherited share of the resale right will pass on to your own successors as per your will, or if there is no will then the intestacy law is applied.

Questions? Please contact us at kiaora@resaleroyalties.co.nz

-

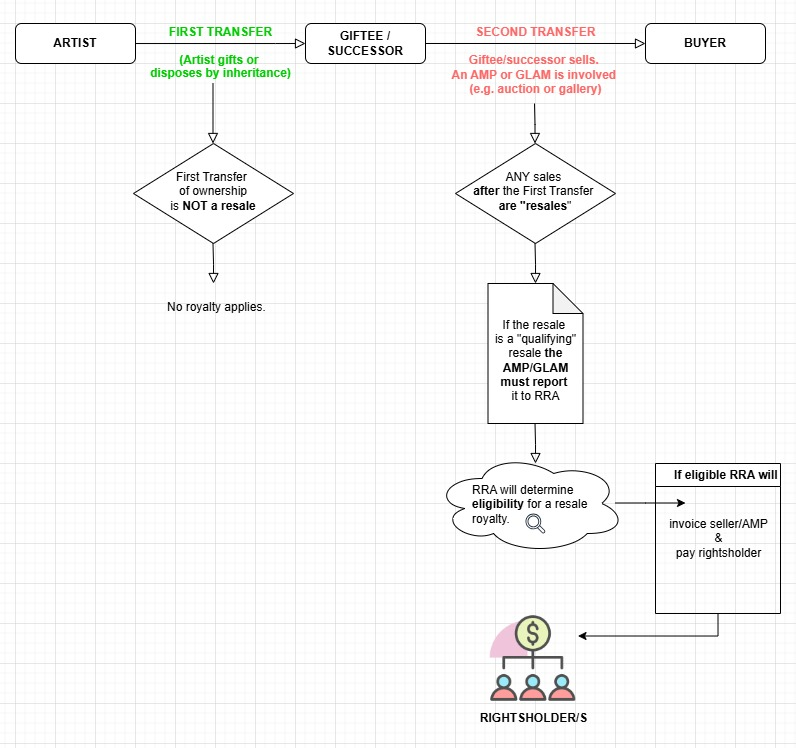

What is a “Resale” and how does this apply to gifted or inherited artworks?

Resale means any sale after the first transfer of ownership (whether for consideration or not).

The scheme therefore applies to all sales after the first transfer of ownership.

How does this apply to sales of gifted or inherited artworks?

Explained in the context of a sale of gifted and/or inherited artwork, that means:

- When the artwork is gifted by the artist, or inherited from the artist:

- This qualifies as the “first transfer of ownership”. This means the first transfer does not count as a “resale”.

- However, when the giftee or successor subsequently sells the artwork:

- This is a sale after the first transfer of ownership. This means it is a “resale”.

- This means the scheme applies to the resale. If an AMP or GLAM is involved in this resale, and the resale is over $2,000, then it must be reported to RRA as a “qualifying resale”.

For a visual representation please see the flowchart below:

- When the artwork is gifted by the artist, or inherited from the artist:

-

What is an “original visual artwork”?

Checklist 2.1: If any of the following boxes are checked, the work is a “visual artwork”:

- cultural expressions of Māori or Pacific peoples;

- painting, drawing, carving, engraving, etching, lithography, woodcutting, printing (including a book of prints);

- sculpture, collage, modelling;

- craftwork, ceramics, glassware, jewellery, textiles, weaving, metalware, furniture;

- photography or video art;

- multimedia art;

- art created using computers or other electronic devices;

- ethnic or cultural art that is a variation of any type of work described above in the 2nd through final bullets.

However, visual artwork does not include:

- a building*;

- a dramatic work* or musical work*;

- a literary work*, unless it is a compilation that includes a visual artwork.

* (These terms are defined in s 2(1) of the Copyright Act 1993)

Checklist 2.2: To be an “original”, the visual artwork must have been:

- Created by, or under the authority of, the artist; or

- One of a limited number of copies of visual artwork made by that artist or under their authority.

-

What is the duration of the resale right period and will this change with the Copyright Act review?

Section 15 of the Act states that the duration of the ARR right is 50 years from the end of the calendar year that the (eligible) artist dies, (or if 2 or more artists create the qualifying artwork, then 50 years from the end of the calendar year that the last surviving artist dies). This is the same duration as Copyright under the Copyright Act 1994, which would imply that the ARR is linked to the duration of Copyright however nothing in the legislation confirms this.

-

When is a resale royalty payable?

An eligible artist” (or their successor) has a right to be paid a resale royalty each time there is a “qualifying resale” of an “original visual artwork” by that artist (provided the resale right had not “expired” at the time of resale)

Use the flowchart in the Criteria section of the Homepage to apply this test in 4 Steps.

-

Who is liable to pay the resale royalty?

The following persons are jointly and severally liable to pay the 5% resale royalty to RRA (section 17, of the Act) :

- The seller, and either

- the agent acting for the seller on the resale (usually the AMP); or

- if the seller does not have an agent, the agent acting for the buyer on the resale; or

- if there are no agents, the buyer.

- The seller, and either

-

Would the term to receive a resale royalty for a UK or Australian artist’s work that is a qualifying resale in New Zealand due to our reciprocal agreements be New Zealand’s term of 50 years, or their longer term of 70 years?

We are applying New Zealand’s legislation but it’s our understanding that this will change in the next few years when the NZ Copyright Act is reviewed.