Lissy and Rudi Robinson-Cole.

-

Ao Mārama ki Ahuru (2023)

Publicly funded Galleries, Libraries, Archives and Museums

Publicly funded Galleries, Libraries, Archives and Museums (GLAM) members have certain obligations and liabilities under the Scheme. These are explained in our Guide for GLAM members.

Please register to stay informed about your obligations under the scheme, and to receive administrative support with compliance.

Select the Register now link to register with RRA.

-

Guide & resources for GLAM Members

Resources to help you understand your obligations as a GLAM member and how the scheme is administered.

-

GLAM: How to report a resale

Guide and checklists for GLAM members explaining how to report a resale

-

How does the scheme affect GLAM members?

GLAM obligations under the Resale Right for Visual Artists Act 2023

FAQs

For GLAM

-

Are GLAM gift shops acting as AMPs when selling original visual artworks to their customers when the first sale is between the artist and the GLAM gift shop?

In this case yes, as the GLAM gift shop can be regarded as “any other person who is in the business of dealing in visual artworks”, they will fit the definition of an AMP under the act. In any event, the obligations will be the same whether they are regarded as a GLAM member or an AMP, as the responsibility will be on them to report and pay the relevant royalty if required.

-

How does the scheme apply to GLAM organisations?

The scheme applies to:

- publicly funded art galleries; and

- publicly funded museums, libraries, and archives that collect and display artworks (“GLAM”).

Three ways the Scheme affects GLAM:

- GLAM are not Art Market Professionals (AMPs).

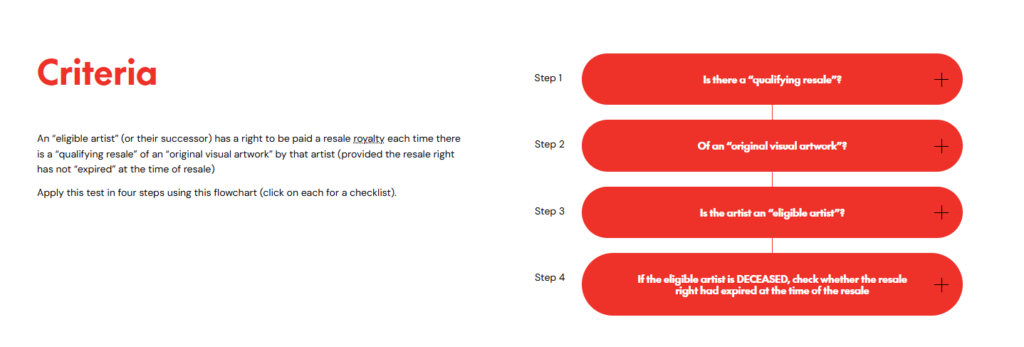

- However, resales involving GLAM do fall within the Scheme. If any GLAM is involved in a resale of original visual artwork it may still count as a “professional resale” and therefore a “qualifying resale”. Forr assistance with what is a “qualifying resale” see our step-by-step Flowchart under the ‘Criteria’ section on our Homepage here.

- GLAM don’t have liability for paying the royalty. Generally, GLAM aren’t required to report to RRA on qualifying resales either, UNLESS there are no Art Market Professionals involved in the resale. In that event, then each GLAM will be responsible for reporting information about the resale to RRA.

-

In the example where a GLAM gift shop is acting as an AMP – are they required to report buyer information for qualifying resales in a retail context (e.g. an American Tourist purchases art)? What if the GLAM gift shop is prepared to assume full liability for the resale?

Section 21 of the Act details the reporting requirements which includes as follows:

(a) the name of the artwork, if known:

(b) a brief description of the artwork:

(c) the resale value:

(d) the name of the artist, if known:

(e)the name and contact details of the persons liable under section 17 to pay the resale royalty, if known:

(f) any other information specified by the regulations.

If the GLAM gift shop assumes full liability for payment of the royalty, then RRA would not require the shop to report the name of the buyer, because liability will be discharged as soon as full payment is received by RRA.

-

In the RRA guidelines, it states RRA will ‘verify’ GLAM’s reports. What does this involve?

RRA will review resales reports for detail and completeness, as defined by the Act and Regulations. The objective of verifying reports is to have complete and accurate information to support rights holder identification and distribution processes, ensuring timely payment to the artist(s) or successors(s).

-

Is protest art an original visual artwork (e.g. a protest placard)?

We consider that each respective GLAM is best qualified to determine whether an item meets the definition of “original visual artwork”. Section 8(2) defines visual artworks as:

In this Act, visual artwork—

(a)includes a visual work of any 1 or more of the following types:

(i)a cultural expression of Māori:

(ii)a cultural expression of Pacific peoples:

(iii)ethnic or cultural art that is a variation of a type of work described in any of subparagraphs (iv) to (ix):

(iv)painting, drawing, carving, engraving, etching, lithography, woodcutting, or printing (including a book of prints):

(v)sculpture, collage, or modelling:

(vi)craftwork, ceramics, glassware, jewellery, textiles, weaving, metalware, or furniture:

(vii)photography or video art:

(viii)multimedia art:

(ix)art that is created using computers or other electronic devices

(b) does not include—

(i) a building, as defined in section 2(1) of the Copyright Act 1994:

(ii) a dramatic work or musical work, as those terms are defined in section 2(1) of the Copyright Act 1994:

(iii) a literary work, as defined in section 2(1) of the Copyright Act 1994, unless it is a compilation that includes a visual work of a type specified in paragraph (a)(i) to (ix):

(iv) a work of a type specified in the regulations.

-

Is the GLAM required to report a qualifying resale in instances where they have not identified the artist? e.g. Maori artifact

Yes. A GLAM must report all “qualifying resales” (even if the identity of the artist is unknown – see section 21(2)(d)).

Please note, however, that not every qualifying resale the GLAM reports will necessarily attract a royalty. If the artist is unknown to the GLAM, RRA will nevertheless attempt to identity the artist in order to confirm whether or not they are eligible for a royalty. RRA will receive and review the full report, then confirm to the GLAM which resales are (or are not) liable for a royalty in accordance with the Act, and then invoice accordingly.

For assistance with what is a “qualifying resale” see our step-by-step flowchart under the ‘Criteria’ section here Resale Royalties Aotearoa | Toi Huarau

-

Should a GLAM purchase an item of jewellery in 2023 attributed to an artist from Palmerston North who died in 1959. Is it correct that this doesn’t qualify for the royalty as the known maker died more than 50 years ago?

Correct this is no longer a qualifying resale (assuming it would otherwise have been), as the right to a resale royalty for this Artist expired fifty years from the end of the year that they died, ie at the end of 2009.

-

We often buy acquisitions as lots and within those lots there might be qualifying items, for example, a sketch valued over $2000. How should we declare a select item?

We suggest using good faith best efforts to do your due diligence, which is probably exactly what you will have done anyway as part of your research into identifying each item you purchase. We recommend you keep written records of your due diligence in case it is needed in the future, but we will not be auditing your decisions unless independently requested to do so.

Report the individual item not the lot and include the details as you can – i.e. the artist’s name and details of the sketch, the seller of the lot, and the date of the acquisition. And again, if in doubt please contact us.

-

What are the GLAMs reporting obligations when reporting a qualifying resale when the purchase is made from a collective? (e.g A group of artists who work collectively or under an umbrella ‘collective’ organisation).

The same reporting rules apply. Assuming it is a qualifying resale (i.e. not a first sale), the responsible party must report the sale under section 21. That must include information about the name of the artist (or artists) if known.

-

What doesn’t count as visual art? Clothing? Or does haute couture count as visual art?

Section 8 of the Act defines what is a visual artwork, and does not refer to clothing – although it does refer to drawings and textiles, so while the clothing items themselves may not be regarded as an original visual artwork, the underlying drawings that they are based may be regarded as an original visual artwork, and the same with the textile designs. Arguably if the clothing item is at the level of a WOW entry, it might be regarded as sculpture and therefore would be included in the definition of an original visual artwork.

-

What if the seller or donor to a GLAM wishes to remain anonymous?

If the GLAM assumes full liability for payment of the royalty, and pays the royalty to RRA, then RRA would not require the GLAM to provide the name and contact details of the seller. The GLAM (and the seller’s) liability becomes fully discharged as soon as full payment is received by RRA.

Regarding any anonymity concerns, please be assured that personal information provided to RRA is not shared publicly. In particular, seller information received by RRA is not shared with the Government nor any other third party – rather it is used only for the purposes of ensuring payment of the royalty to RRA. Please refer to our Privacy policy for more information.

-

What is the time limit for retrospectively reporting a resale when additional information to support a qualifying resale becomes available?

Section 17 (2) of the Act states that the liablity for payment of a resale royalty arises on completion of the qualifying resale, and Section 17 (3) of the Act states that liability is discharged when the total amount of the resale royalty is paid to the Collection Agency. This means that there is no time limit for retrospectively reporting a resale, and so in the event you discover a liability you must report and make payment to RRA within the timeframe (Section 17 (4). Section 8 of the Regulations states the applicable time frame is as follows:

Payment of the resale royalty must be made to the collection agency within 60 working days after the later of the following:

(a) the date on which the qualifying resale is completed:

(b) the earliest date on which a person liable under section 17 of the Act to pay the resale royalty becomes aware that they are liable to pay the resale royalty.

-

When a GLAM that operates a gift shop makes a sale of an original visual artworks that has been purchased directly from the artist, is this regarded as qualifying resale?

If the GLAM gift shop has actually purchased the original visual artworks from the artist, this is the initial sale, and when the GLAM gift shop sells the item to their customer this is a resale which will be regarded as a qualifying resale, assuming the other criteria are met.

If however, the artist has instead consigned the original visual artworks to the GLAM gift shop to sell on their behalf, then there has not yet been any sale or transfer of ownership as ownership remains with the artist, in which case when the GLAM gift shop sells the original visual artwork to their customer it will be the first sale rather than a qualifying resale and no reporting or royalty will be required.